COVID 19 – Impacting all facets of human existence

The health crisis caused by the COVID-19 pandemic is causing significant changes across the world like those witnessed during the Spanish influenza of 1918.

Analysts and experts are predicting that the pandemic will significantly restructure global systems; shift geopolitical power; redistribute wealth; modify how we interact and open new markets like the Industrial Revolution.

While some industries will witness minimal changes to their markets as a result of the containment measures being adopted, other industries are expected to witness significant changes as a result of this pandemic.

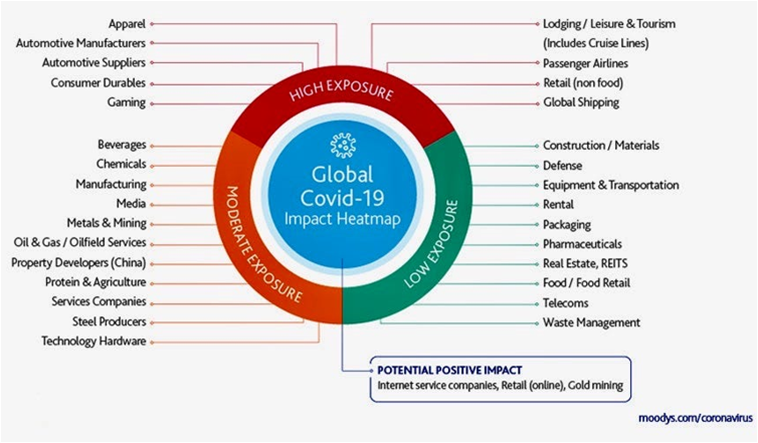

Figure 1 shows the impact of the COVID-19 pandemic on various industries.

The Oil & Gas industry is expected to experience a moderate exposure.

Without doubt, this pandemic is reshaping the environment and weighing significantly on macroeconomic indices.

Global Economic Impact

Although predicting the degree of economic impact of the COVID-19 pandemic is be challenging, there is widespread agreement that the outlook of the global economy is less positive than it was a year ago.

Growth forecasts have been significantly lowered across the globe with certain scenarios approaching levels not seen since the 2008 financial crisis.

Implications for the Global Oil & Gas Industry

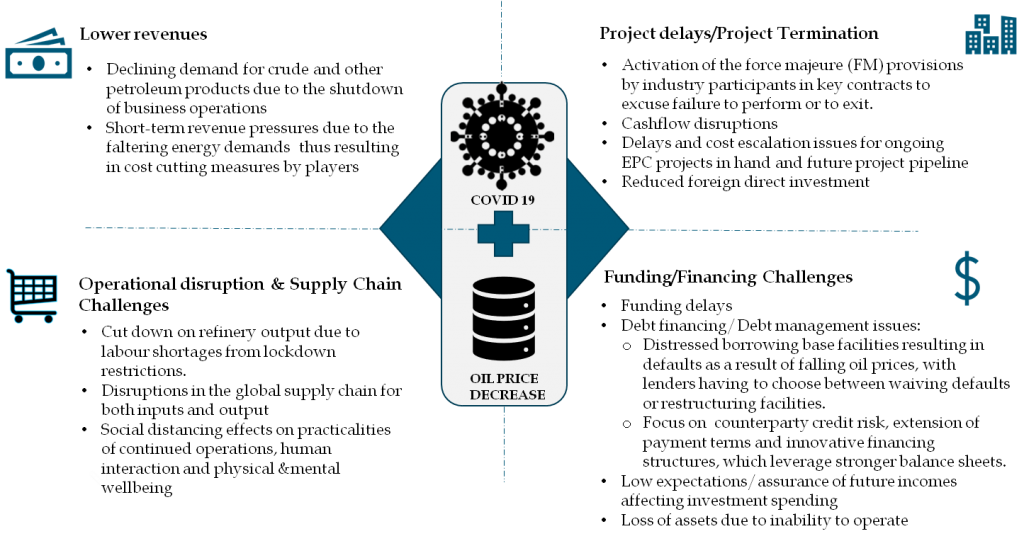

While the impact of the pandemic on the Oil & Gas sector is expected to moderate, mostly reflected in lower demand from the shut down of business operations across the world, lower oil prices caused by the oil wars has further impacted operations in the oil & gas industry.

Global oil demand has been hit hard by the Novel Coronavirus (Covid-19) and the widespread shutdown of China’s economy; and is unlikely to return to normal until Q3, 2020. Data shows a demand drop of about 3 million barrels per day in Q1- 2020 due to the pandemic. A summary of the impact on the oil and gas industry is shown below:

Global Outlook Forecasts

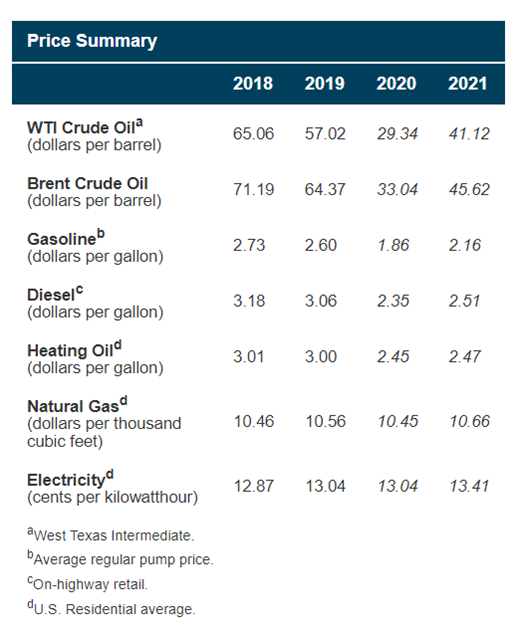

Despite falling crude oil prices, largely driven by the economic contraction caused by COVID-19 and increase in crude oil supply, the EIA forecasts that Brent crude oil prices will average $33/b in 2020, but will rise to an average of $46/b in 2021, as a return to declining global oil inventories puts upward pressure on prices •

Firmer demand growth as the global economy begins to recover and slower supply growth will contribute to global oil inventory draws beginning in the fourth quarter of 2020. EIA expects global liquid fuels inventories will decline by 1.7 million b/d in 2021. •

These forecasts will however be affected by the sustainability of the current drive to alternatives from renewable energy. However, the current downturn presents opportunities for restructuring, strategic acquisitions and investments for long term value addition.These forecasts will however be affected by the sustainability of the current drive to alternatives from renewable energy. However, the current downturn presents opportunities for restructuring, strategic acquisitions and investments for long term value addition.

Timeline of current oil price movement – Qtr1, 2020

China consumes 13.5 million barrels per day (bpd) of crude oil annually according to a 2018 estimate, of which around 62% is obtained through imports. The lockdowns and travel restrictions imposed in some of the major cities across China have resulted in declining consumption of petroleum products in the country and across the world.

Nigerian Oil and Gas Market Review

Declining Demand for Crude

The Asian and European market are the primary markets for Nigerian crude, taking about 65% of the supply, while also accounting for 80% of petroleum gas exports.

The top 5 destinations for Nigerian crude oil exports were India, US, Spain, France and Netherlands.

Chinese refineries have cut throughput to 2.9million barrels per day. These and recent data on the COVID-19 pandemic suggests that the market for Nigerian products has been significantly affected.

Therefore, Nigerian operators will have to develop strategies to mitigate the potential drop in offtake.

Fuel Subsidy Removal

The recent decline in crude oil prices globally has allowed the Federal Government of Nigeria (FGN) to effectively end the subsidy scheme on PMS,

Available data shows that in 2019, Nigeria consumed about 27 billion liters of refined petroleum products.

The consumption volumes have grown at an average annual rate of 4% over the past 5 years.

There is also potential offtake of refined products from other western African countries as available refining capacity exceed Nigerian demand levels.

Consumption volumes this year might drop due to COVID-19, however, opportunities exist in the short, medium, and long term for Nigeria to increase its refining capacity and for improved collaboration between the government and private sector and the use of gas to power the economy.

Subsidy removal and deregulation present opportunities

Imperatives for Businesses – Opportunities and Challenges

The energy industry is likely to continue to struggle due to depressed oil prices, and revenue, and production declines especially for those at risk of being unable to refinance debt or meet existing debt covenants. Even in a most optimistic case, the industry may face a prolonged recovery period of up to two years. However, joint energy policy agreement between OPEC and Russia could shorten the recovery period.

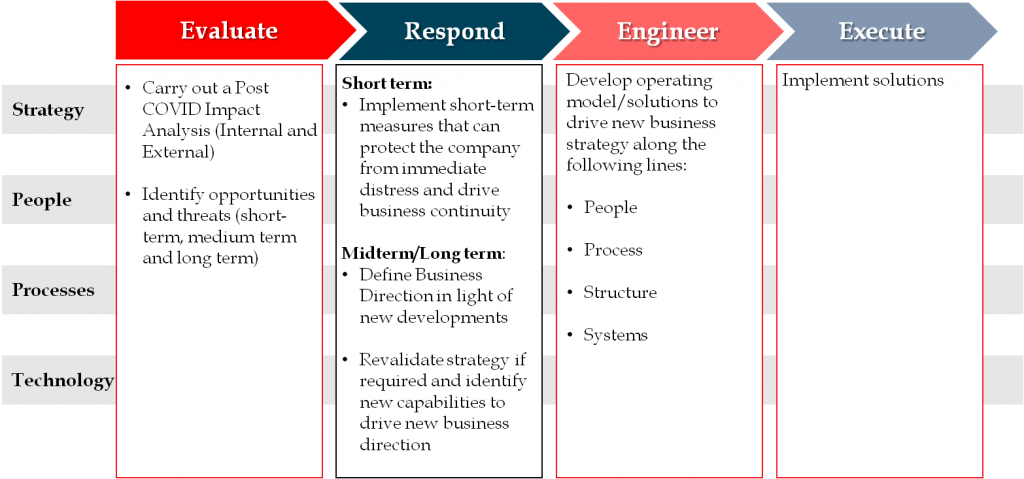

The pandemic has already disrupted the way organizations run, creating a need to review existing operating models, explore new ways of doing business and challenge the status quo. It is imperative for organizations identify areas of immediate concern, consider medium to long term effect of the changes in the environment and take necessary actions to position their organizations to thrive in the new operating environment. In our opinion, actions that organizations can take at this time include:

BUSINESS STRATEGY AND OPERATING MODEL REVIEW

Review of business strategy and operating model in light of current and foreseeable changes in the operating environment. This may involve:

- Diversifying business offerings and services in light of foreseeable trends.

- Enabling stronger digital operations as the shift to remote working reveals gaps in digital customer contact channels, IT infrastructure and digital workforce competency.

- Planning for the best and preparing for the worst trajectories using robust scenario planning.

- Assessing divesting and M&A opportunities

SUPPLY CHAIN OPTIMIZATION

The pandemic has led to a disruption of the global supply chain severely affecting business operations. Organizations can adjust and learn from this by:

- Diversifying the supply chain i.e. exploring alternative sources of input/raw materials particularly local sources.

- Renegotiations of existing contracts with key vendors/partners to manage costs.

- Reviewing supply chain strategies

WORKFORCE MANAGEMENT

Organizations therefore must begin to develop competency for managing a virtual workforce by:

- Developing the right policies, structure and culture for remote workforce management.

- Assessing the suitability of existing information technology and communications infrastructure to support remote working.

- Examining regulatory and compliance requirements for virtual workforce management

FUNDING/FINANCE MANAGEMENT

Lower revenues and cash flow challenges are typical outcomes of recessions. To address this, organizations can do the following:

- Review profitability and cashflow projections. Identify the financial and operational levers that can be pulled to conserve and generate cash, and potentially increase access to funding.

- Revise operating and capital budgets.

- Explore debt refinancing options.

- Explore interventions provided by the government.

BUSINESS PROCESS OPTIMIZATION

Business Process Optimization, with a view to achieving cost savings and process efficiency. This may include:

- Review of core and supporting business processes to identify opportunities for optimization or automation.

- Elimination of redundant or non-value adding activities.

- Improved use of technology.

- Outsourcing of corporate and non-core business processes to drive costs down and create better efficiency.

PROJECT MANAGEMENT/PROJECT DELIVERY ASSURANCE

The slowdown in the economy is also likely to affect capital projects and necessitate the review of current projects. This may include:

- Project cost management.

- Project delivery assurance.

- Future Project pipeline review.

- Project planning and risk management.

Organizations can respond to these opportunities and challenges, along the 4 dimensions of Strategy, People, Processes and Technology as shown below:

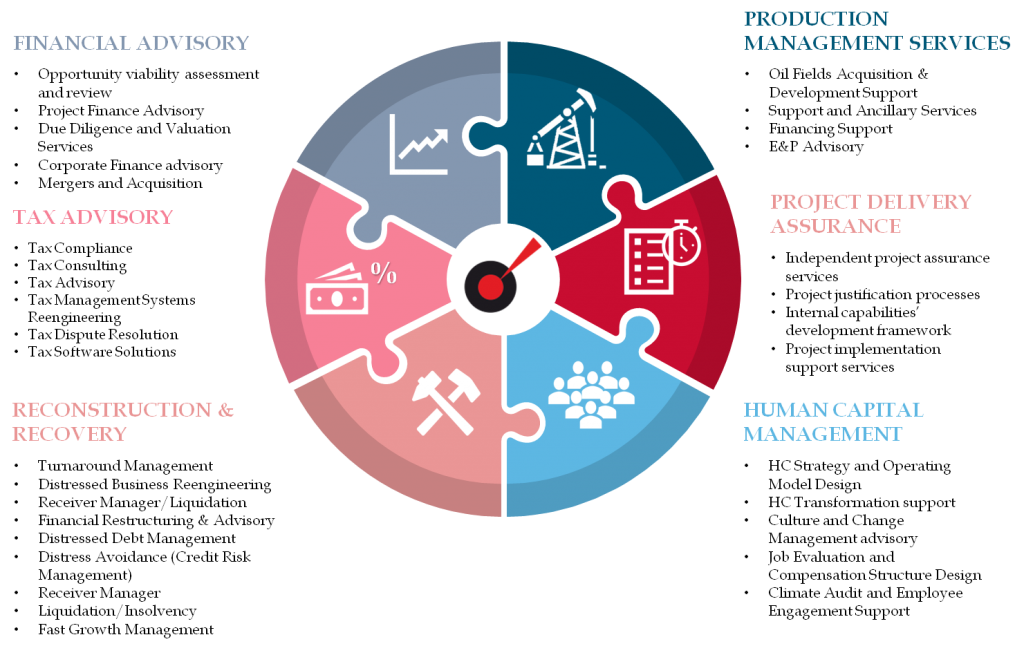

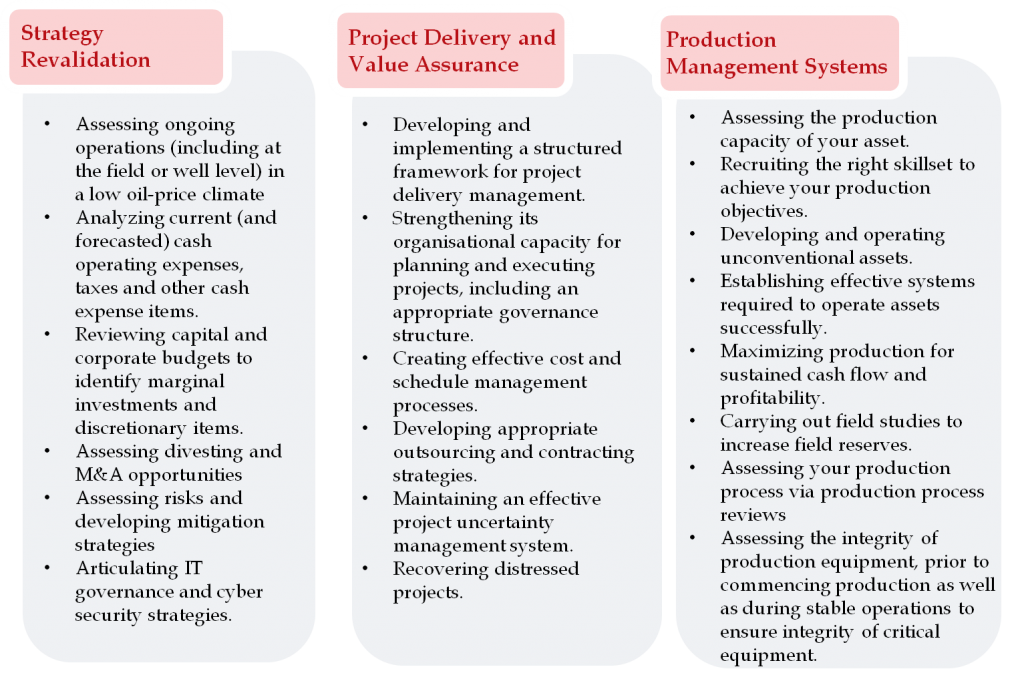

To exploit these emerging opportunities, oil and gas players will need support in:

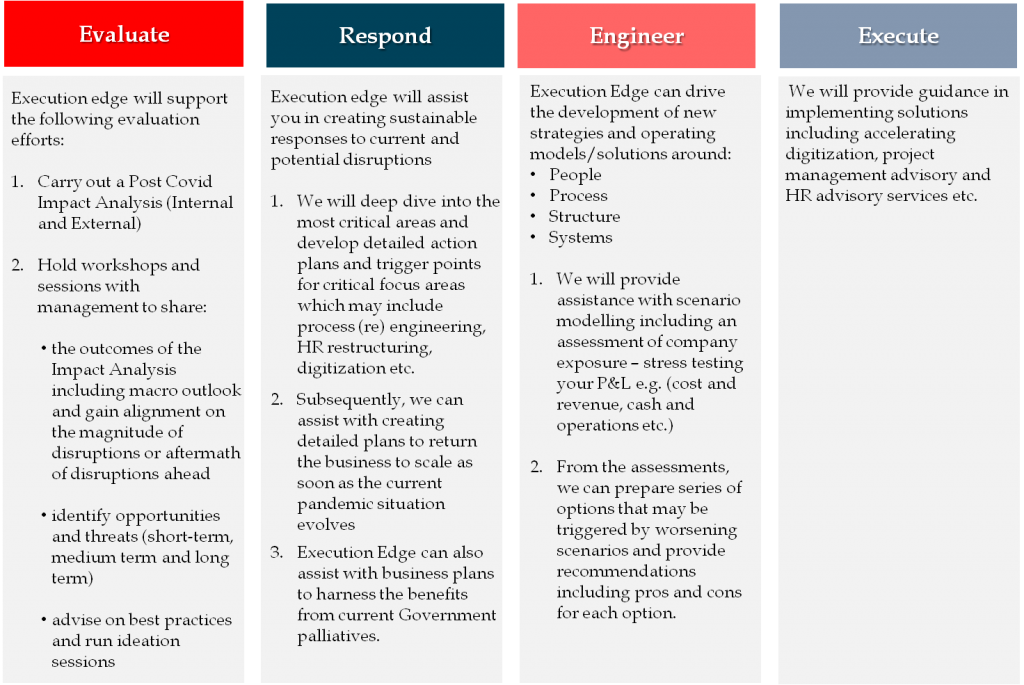

Execution Edge is well positioned as a trusted business partner to support your organisation to build resilience and emerge stronger through the pandemic and economic knock on effects. We can support you though each or all the 4 dimensions highlighted earlier.

About Execution Edge

Execution Edge (EE) is an advisory and management consulting firm with strong capabilities and experience in providing value-driven enterprise transformation solutions. We bring capabilities that will deliver enhanced business performance, improve bottom-line savings and business growth.

With over 130 years of collective management consulting and management experience, Execution Edge has deep knowledge of the Nigerian business environment, with proven experience in taking enterprises to leadership positions in their chosen markets.

Our services cut across various facets of businesses, governments and institutions.

With a team of highly skilled and experienced professionals, we deliver innovative and practical “hands on” advisory services that will give our clients a competitive edge in the marketplace.

Contact Us

Malije Okoye

CEO

E mail: malije.okoye@executionedge.net

Tel: 01-2776141

Cell: 08093663487

Terkimbi Ibunde

COO

E mail: terkimbi.ibunde@executionedge.net

Tel: 01-2776141

Cell: 07034617803

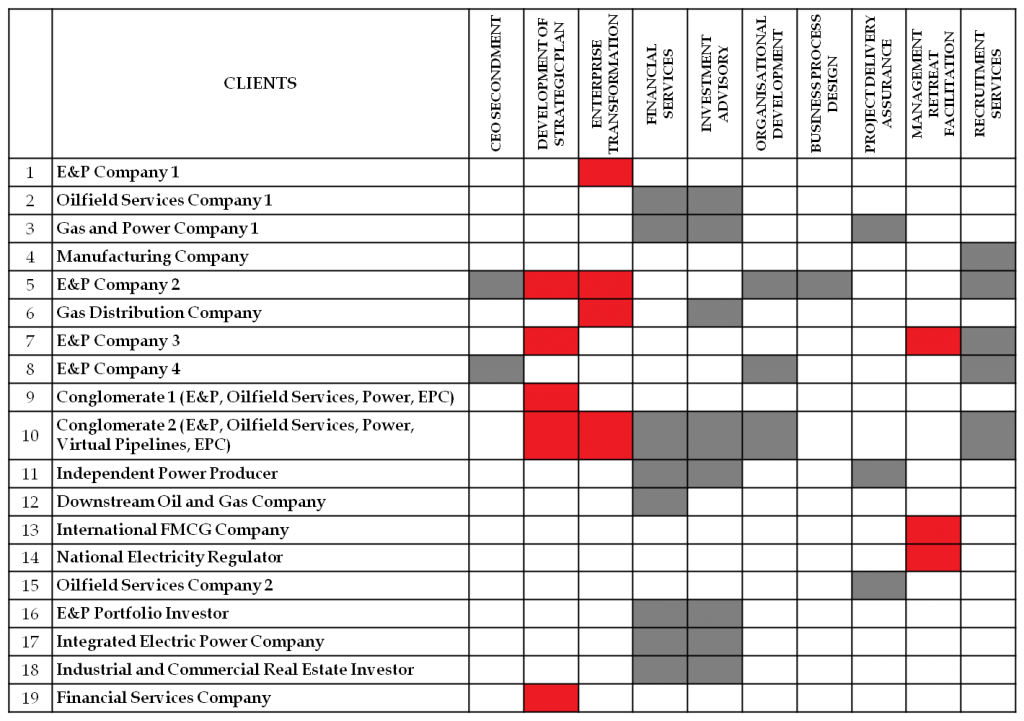

We have varied industry experience and credentials

Our core competence and range of services